MetaMask Guide: Ideas on how to Establish, Create Communities, and you may Money Your own Purse Safely

15 de Setembro, 2025Gambling on line is greatly preferred in australia, but not most of the web based casinos are made equivalent

15 de Setembro, 2025If any deltas are nevertheless unresolved if the PoolManager locks, the complete deal reverts. That it guarantees that token movements balance towards the end of your exchange. The newest macroeconomic grounds will continue to feeling UNI’s price, nevertheless the v4 modify may help Uniswap win back certain impetus inside the the fresh extreme DEX business.

step 3 Flash Accounting: Uniswap app

Uniswap v4 is actually revealed inside June 2023 and you can commercially launched inside the March 2025. To the DeFi area, they depicted an opportunity to change the brand new reason away from decentralized exchanges and on-strings exchange. Inside the earlier incarnations away from Uniswap, liquidity organization (LPs) needed to dispersed their money uniformly along the entire spending budget.

- Uniswap V4 operates beneath the Company Supply Permit step one.1, and therefore restrictions commercial fool around with for a four year several months.

- Industry insiders imagine you to Uniswap V4 you may utilize handling latest pain things, such as large transaction fees and you can limited adjustment choices.

- So it construction reinforces gasoline efficiency as one of the basic Uniswap v4 provides.

- In this analogy, the new bad delta (-1e18) mode the brand new executor owes step 1 ETH to the PoolManager, since the confident delta (+2000e6) function the fresh executor is eligible to receive 2000 USDC.

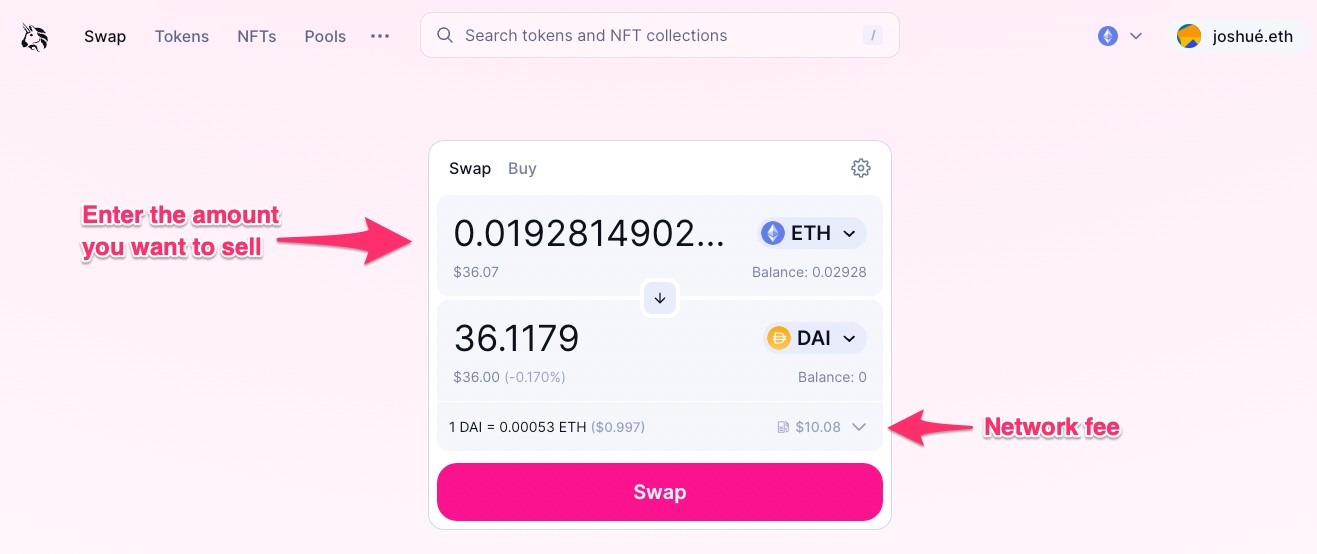

Uniswap v4 introduces an active percentage program you to immediately changes so you can Uniswap app market standards. Rather than fixed prices, liquidity pond fees can fluctuate considering volatility, exchangeability, and change consult. Uniswap v4 introduces flash bookkeeping, another settlement system made to lower energy fees by eliminating a lot of token actions inside process. Uniswap v4 scratches the greatest development from decentralized exchanges (DEXs) yet. So it modify aims to get rid of exchange charge, improve exchangeability management, and you may permit designers that have complex equipment for building customized DeFi software.

Such potential improvements seek to harden Uniswap’s popularity in the DeFi ecosystem. In pursuit of a more unlock and you can reasonable economic climate, the new Uniswap Foundation supporting the organization, decentralization, and you can sustainability of one’s Uniswap neighborhood. Find out about the new center principles of your own Uniswap Process, Exchanges, Swimming pools, Exchangeability, and more. The fresh sequence of these parameters need satisfy the succession from actions we defined earlier (SWAP_EXACT_IN_Single, SETTLE_The, or take_ALL). Governance can choose to add a process percentage to any pond, around a good capped matter.

- While the accurate launch time remains unclear, Uniswap V4’s teaser indicates the fresh wait would be worthwhile.

- Uniswap, a greatest Ethereum-founded decentralized replace, try likely to launch their long-awaited v4 expansion recently.

- Uniswap v4 is an automated market creator (AMM) concerned about alteration and architectural changes for gasoline performance improvements.

- Uniswap developers detailed several trick features of v4, the most significant where is actually hooks.

Andrew Tate Online Worth 2025: Crypto Holdings & Purse Target

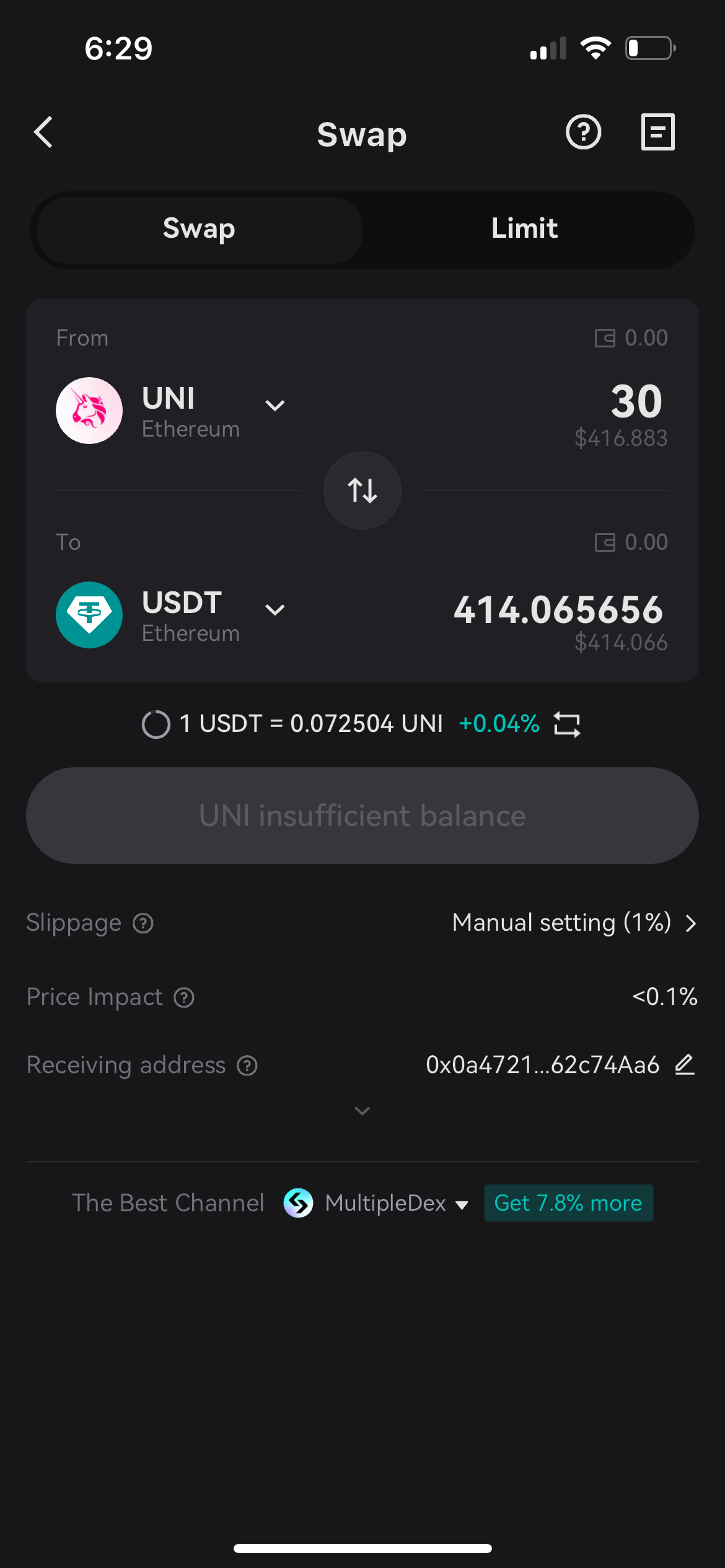

UniswapX outsources navigation difficulty to an open circle away from 3rd-people fillers which up coming participate to find the best price across liquidity supply. Along with her, these complementary protocols help render users the best swapping sense. The positioning Manager’s demand-founded construction makes you create several liquidity surgery inside the a good solitary exchange.

While the crypto locations have changed, very has our understanding of those things you to definitely sense works out to have pages. Governance stays a foundation out of Uniswap’s procedures, with its DAO managing a good $5.4 billion treasury, far exceeding the brand new Ethereum Base’s $919 million. More 356,100 token holders and you may a dynamic voting area train robust involvement, averaging 1 to 2 proposals month-to-month. And you can keep in mind that i place minimums to 0 for commission range since the charge cannot be controlled within the a front-focus on attack. This really is distinct from almost every other liquidity functions in which form suitable lowest quantity is crucial to own slippage protection. Rather, charge is actually gathered that with Drop off_Liquidity having zero exchangeability.

With regard to analogy, let`s say an individual will have to import additional tokens. Observe that financing regarding the earliest status is actually immediately put to the the following reputation as a result of flash accounting. When deleting exchangeability from a position, you’ll have the ability to discover tokens and you can one accumulated fees.

The fresh KYC and you can Term Hooks incorporate KYC monitors and you will name confirmation on the platform, making certain only verified users can also be change. Depending on how the new regulating ecosystem change, this can be required. The new Volatility Oracle hook contact the lack of on the-chain volatility metrics in the DeFi, bringing crucial investigation to possess prices derivatives such alternatives. This allows DeFi giving more complex things, bringing they nearer to antique financial segments. Following, the fresh initialize() setting on the Pond library is named to your Pond struct, which populates the new slot0 struct on the pond condition.

They allow for exact, programmatic changes on the negative effects of surgery in the method. As previously mentioned in the Notion of Hooks, hook up contracts mean the adopted functions by encoding their choices inside the brand new address of your own deal. The newest PoolManager spends this type of permissions to decide and therefore hook services so you can require confirmed pool. Uniswap v1 is a research within the exchangeability creation to evaluate if AMMs got a place inside the crypto.

By integrating ETH into exchangeability pools, Uniswap V4 eliminates inefficiencies caused by liquidity fragmentation anywhere between ETH and you can WETH swimming pools. Inside the Uniswap v4, the brand new protocol have up-to-date of ERC-1155 so you can ERC-6909 to maximize token says, redemptions, and you will exchangeability ranking. For many who’ve utilized Uniswap ahead of, you’ve interacted that have exchangeability pools — nevertheless may well not understand how they work behind the scenes.

Uniswap v4 introduces groundbreaking structural updates aimed at increasing features and you can user experience. Key have were “hooks,” permitting personalized code delivery before and after swaps, assisting state-of-the-art functionalities such limit requests and automatic exchangeability actions. Trick developments are flash bookkeeping to minimize token transfers, active fees one comply with market conditions, and you will a great singleton bargain you to definitely consolidates all exchangeability pools to your you to system. The fresh upgrade along with restores native ETH trade, removing the necessity for WETH, and introduces hooks to own deeper pool modification. The newest upgrades within the Uniswap v4 often help the consumer experience, keep your charges down, and gives much more alternatives for people and you can exchangeability organization and offers more independence and you may control over charge.

If the investment’s rate went additional so it diversity, their exchangeability manage briefly become lifeless. Because of the starting an excellent programmable commission structure, Uniswap V4 enhances funding efficiency and you may field fairness. Uniswap V4 regulates indigenous ETH exchange, reducing the need to wrap and you will unwrap ETH to the WETH.

First, we should instead install our investment and you may import the necessary dependencies. Remember that helper contracts employed by testing take place in the v4-core/src/test subfolder within the src folder. One the new attempt helper deals might be added here, but all the foundry tests are in the fresh v4-core/attempt folder.